Every year, charitable-minded Americans over age 73 face a dilemma: what to do with the mandatory taxable distribution—otherwise known as a required minimum distribution (RMD)—from their Traditional individual retirement account (IRA).

One option is to make a qualified charitable distribution (QCD) and contribute directly to qualified 501(c)(3) public charities1 without counting the distribution as taxable income (if age 70½ or older). Thus, you can receive a tax benefit from your charitable contribution even if you do not itemize deductions.

Another option is to make a tax-deductible contribution to a donor-advised fund (DAF). While IRA distributions to DAFs are counted as taxable income, contributions also qualify for a charitable tax deduction for itemizers. Despite this difference in tax treatment, DAFs provide an attractive way to achieve charitable giving objectives due to their flexibility and growth potential, among other advantages.

While both options provide tax advantages, the difference in tax savings can be substantial. Please consult your tax professional for guidance.

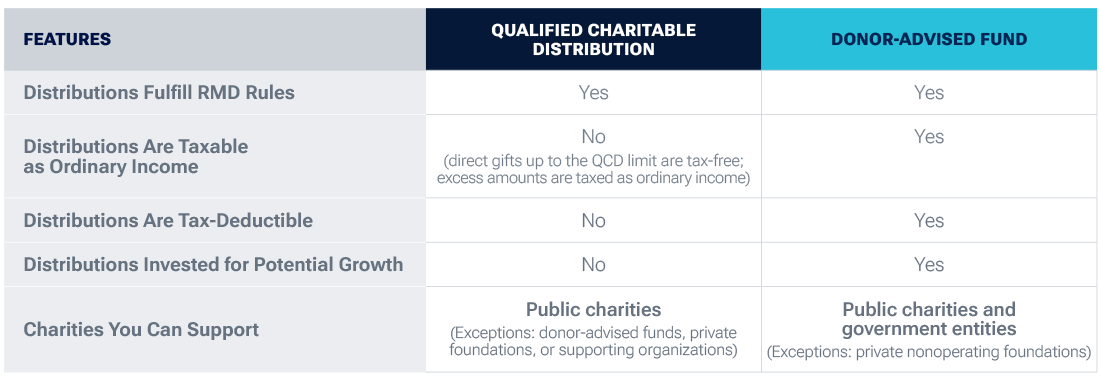

Compare Features: QCD versus DAF

Finding the right fit: QCD versus DAF

QCDs offer a tax-efficient and simple way to satisfy your RMD while also achieving charitable giving objectives. However, there are also advantages to routing your IRA distribution to a DAF instead for a more flexible and strategic approach to charitable giving.

Giving through a QCD offers straightforward tax savings.

A QCD is a direct distribution to a qualifying charity.

A QCD may be right for you if:

- You want to make a tax-free withdrawal and are age 70½ or older.

- You know which charities you want to support immediately.

- You want the charity’s check to be mailed to your address.

- You want to gift up to the annual QCD limit.

Giving through a DAF offers simplicity and flexibility.

Think of a DAF as a charitable account that enables you to initiate, invest, and distribute charitable gifts at your convenience.

A DAF may be right for you if:

- You want to support multiple charities with one IRA distribution and can meet the DAF contribution minimum.2

- You have long-term charitable goals, which could benefit from the potential growth offered by a DAF.

- You want to involve your family in creating a charitable legacy.

- You want to gift over the annual QCD limit.

Consider T. Rowe Price Charitable for your QCD alternative.

T. Rowe Price Charitable offers the potential to grow your contributions over time and grant to multiple charities when you want to. Open an account today, and give your contributions the potential to grow tax-free in a range of investment pools managed by T. Rowe Price. All pools are subject to market risk, including possible loss of principal.

It also offers:

- Flexibility to donate cash or appreciated stock and other assets.

- Immediate tax deduction for itemizers up to IRS limits.

- Online recordkeeping and account management.

- Ability to name successors and pass down your passion for giving.

Extend your philanthropy with a donor-advised fund.

1 Beginning in 2023, the QCD annual limit is indexed for inflation.

The SECURE 2.0 Act allows for a one-time QCD election of up to $50,000 (indexed) to be paid directly to a charitable remainder annuity trust, charitable remainder unitrust, or charitable gift annuity.

2 Minimum initial opening contribution is $5,000 for T. Rowe Price Charitable. No minimums for subsequent contributions.

This material has been prepared for general and educational purposes only; it is not individualized to the needs of any specific donor and not intended to suggest any particular investment strategy is appropriate for you. Any tax-related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Donors are advised to seek professional tax advice regarding questions related to year-end donations.

T. Rowe Price Charitable is an independent, nonprofit corporation and donor-advised fund founded by T. Rowe Price to assist individuals with planning and managing their charitable giving.

© 2025 T. Rowe Price Charitable, Inc. All rights reserved. T. ROWE PRICE and T. ROWE PRICE CHARITABLE are trademarks of T. Rowe Price Group, Inc.

- 3383533