The desire to have an impact on the world beyond your lifetime is a common human aspiration. When you consider ways to further your charitable legacy goals, it’s important to understand the options, to discuss your plans with family and your financial advisor, and to choose the right giving strategy.

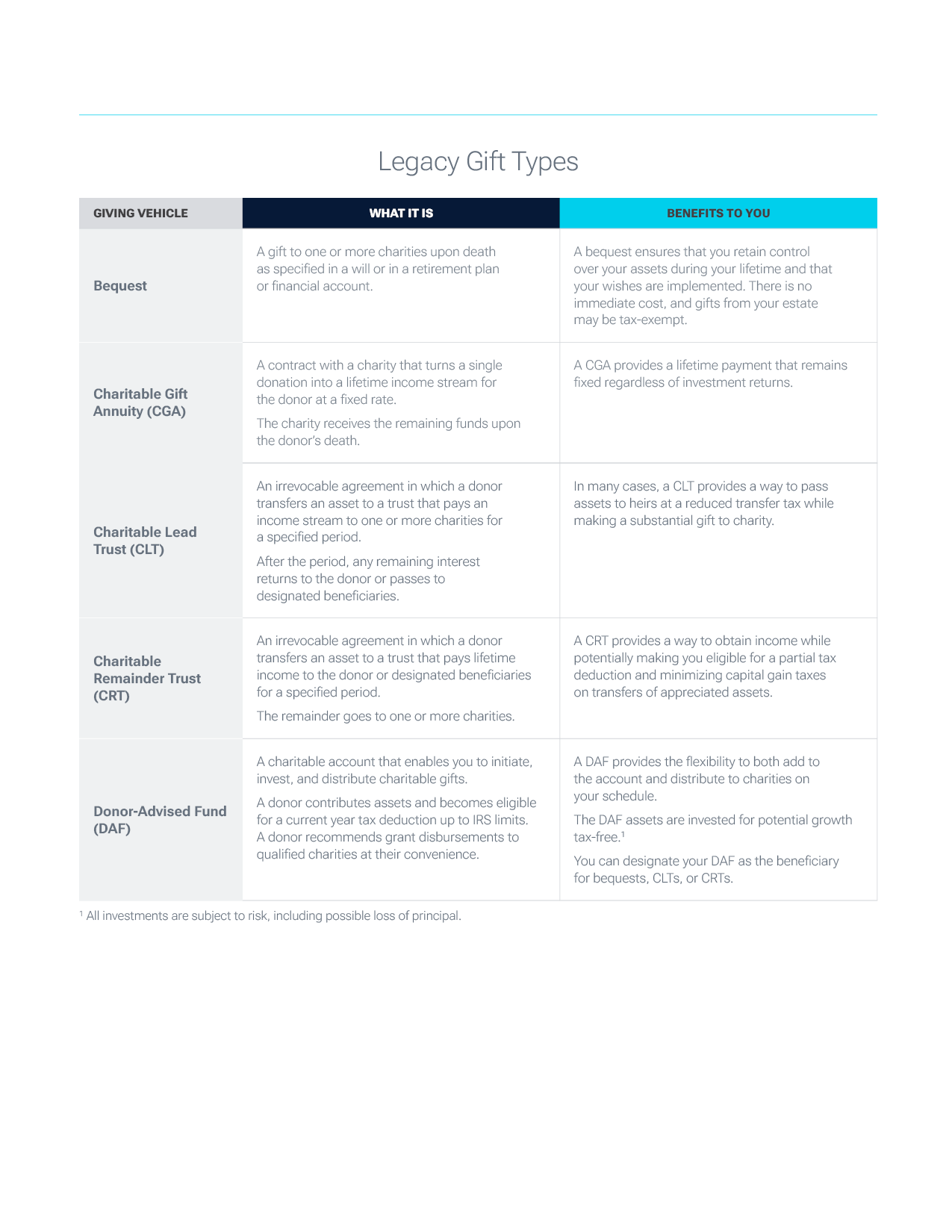

Some factors to consider when you plan your giving legacy include time span, setup, ongoing costs, tax efficiency, flexibility, and successorship. In the accompanying chart, we compare a few charitable legacy gift types to consider.

Legacy Gift Types

Legacy Giving with T. Rowe Price Charitable

A T. Rowe Price Charitable DAF offers several legacy giving options for donors interested in simplicity, flexibility, and low costs. Among other advantages, it gives you the ability to:

- Name successor(s) to inherit the DAF’s advisory privileges.

- Split the DAF into two or more new accounts, giving successors their own DAF to manage.

- Distribute the DAF to charitable organization(s) in a lump payment.

- Request that recurring annual grant distributions be made to one or more charities following your death.

Extend your philanthropy with a donor-advised fund.

1 All investments are subject to risk, including possible loss of principal.

T. Rowe Price Charitable is an independent, nonprofit corporation and donor-advised fund founded by T. Rowe Price to assist individuals with planning and managing their charitable giving.

© 2026 The T. Rowe Price Program for Charitable Giving, Inc. All rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators are trademarks of T. Rowe Price Group, Inc. All other registered trademarks and service marks are the property of their respective owners.

- 5212315