A donor-advised fund, such as T. Rowe Price Charitable, makes it easy to turn almost any asset into gifts for your favorite charities. Donating long-term appreciated assets qualifies you for an immediate charitable tax deduction1 and avoids capital gains tax.2 With T. Rowe Price Charitable, you can realize tax savings now and maximize your charitable impact.

Look Beyond Cash to Optimize Charitable Giving

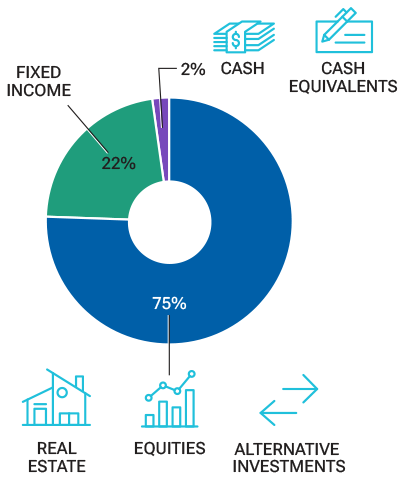

For high-net-worth individuals, cash or cash equivalents represent only about 2% of their wealth, while nearly 75% is held in equities, real estate, and alternative investments.3

This suggests that, for many donors, appreciated noncash assets could play a more significant role in their charitable giving strategy, benefiting both the donor and the charity.

Noncash Contributions: Doing Good for Both Donors and Charities

Donors should consider noncash assets prime candidates for donation because they are often highly appreciated—meaning, if they were sold, there would most likely be significant capital gain. That’s why contributing these assets presents an appealing proposition for donors and charities alike:

Donors

- Minimize or potentially eliminate capital gains taxes

- Are eligible for an immediate tax deduction for the fair market value4 of the asset

- Gain added liquidity by holding the cash they might have otherwise donated

Charities

- Receives the full value of the asset as an in-kind transfer

- Can do more good in the world

How to Maximize Noncash Charitable Giving

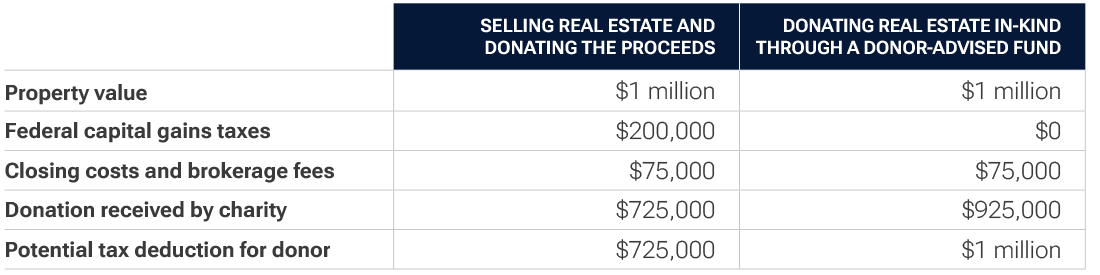

How you choose to donate your appreciated noncash assets can make a significant difference in your potential tax deduction and the impact you’re able to make. Consider the example below:

Special Considerations for Donating Noncash Assets

- Donations valued at over $5,000 require a “qualified appraisal,” as defined by the IRS.

- Deductions for noncash donations are limited to 30% of adjusted gross income in the year of contribution.

- Assets that have debt can still be donated but may result in tax complications. This includes debt inside a pass-through business entity and mortgages on real estate.

Use our calculator to estimate your tax savings.

Optimize your tax savings.

1 Up to 30% of adjusted gross income.

2 Up to 23.8% of capital gains tax.

3 Asset allocation of ultra and high net worth individuals in the United States in 2023, by asset type. Retrieved on 2.8.2024 from https://www.statista.com/statistics/1270098/asset-allocation-of-ultra-and-high-net-worth-individuals-in-the-united-states/

4 Per IRS rules, fair market value is determined by a qualified appraiser for nonpublicly traded assets. All investment pools are subject to risk, including the possible loss of principal.

T. Rowe Price Charitable is an independent, nonprofit corporation and donor-advised fund founded by T. Rowe Price to assist individuals with planning and managing their charitable giving.

© 2025 T. Rowe Price Charitable. All Rights Reserved. T. ROWE PRICE is a trademark of T. Rowe Price Group, Inc. and used under license

- 3391763