Look beyond cash giving

Do you own assets that have appreciated in value? Selling them may trigger significant capital gains taxes. Instead, consider using those assets to give more to your favorite charities and potentially eliminate capital gains taxes.

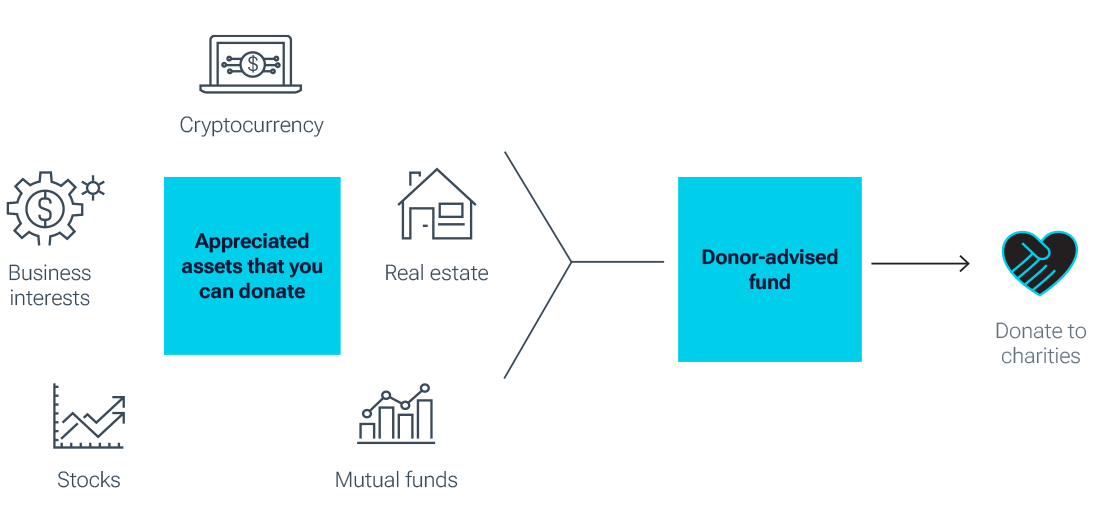

Converting assets into charitable gifts

A donor-advised fund, such as T. Rowe Price Charitable, makes it easy to turn almost any asset into gifts for your favorite charities. Donating long-term appreciated assets qualifies you for an immediate charitable tax deduction1 and avoids capital gains tax.2 With T. Rowe Price Charitable, you can realize tax savings now and build a legacy of giving.

How donating appreciated assets can deliver both tax and charitable benefits

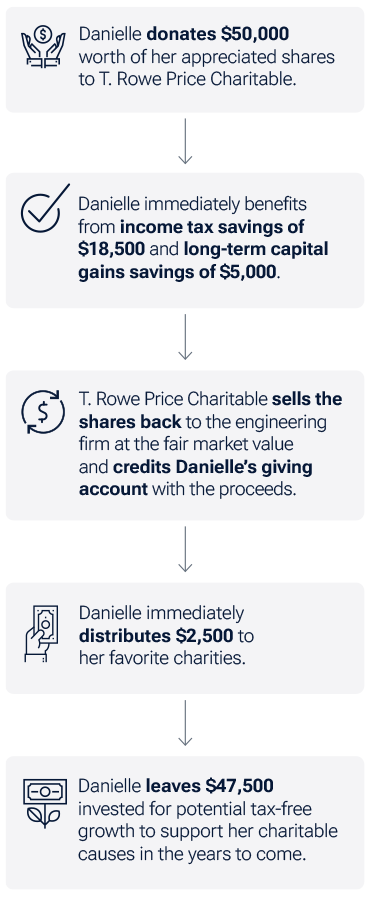

In this hypothetical example, Danielle is a long-time employee of a successful engineering firm and has accumulated highly appreciated private company stock. She’d like to use some of that stock value to increase her charitable giving now and build her charitable assets for greater use in her retirement years.3

Benefits to Danielle

- Qualifies for a same-year charitable tax deduction up to 30% of her adjusted gross income for donating her appreciated stock.

- Avoids paying a capital gains tax of up to 23.8% on the value of the appreciated stock.

- Is able to invest contributions in unique investment pools composed of mutual funds managed by T. Rowe Price, a world-class investment manager focused on delivering strong returns over time.

- Supports domestic or foreign charities, with recognition or anonymously, conveniently from her online giving account.

- Involves family members in managing her giving account and creates a legacy of giving.

Greater charitable impact over time

Let’s assume that Danielle’s account has a 7% annual rate of return and she distributes 5% of her giving account annually to charity. In 10 years, Danielle will have4:

Use our calculator to estimate your tax savings.

1 Up to 30% of adjusted gross income.

2 Up to 23.8%.

3 Assumes Danielle's income tax rate is 37%, long-term capital gains tax rate is 20%, and the cost basis of the $50,000 in appreciated stock was $25,000.

4 The 7% annual rate of return is an assumption and not guaranteed. This example is provided for illustrative puposes only and is not meant to represent the returns of any specifice investment. Actual results will vary and may be better or worse than the example provided.

5 Assumes the annual 5% distribution is made at year-end.

All investment pools are subject to risk, including the possible loss of principal.

T. Rowe Price Charitable is an independent, nonprofit corporation and donor-advised fund founded by T. Rowe Price to assist individuals with planning and managing their charitable giving.

© 2026 The T. Rowe Price Program for Charitable Giving, Inc. All rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators are trademarks of T. Rowe Price Group, Inc. All other registered trademarks and service marks are the property of their respective owners.

- 5226056